Whether it’s called people skills, empathy, or self-awareness, emotional intelligence is now firmly established as a critical component of business success. Hard to measure but easy to recognise, a team with high EQ is better equipped for the emotional rollercoaster of a business sale.

For most founders and entrepreneurs, selling a business is an intensely personal episode where potential acquirers or investors come along and start poking about asking searching questions. They often query your structure, interrogate your numbers, or wear you down with seemingly endless questions.

Later in the sale process, stressful moments converge as talks turn to valuation, warranties and liabilities, or earnouts. Then it’s time for forensic examination in the due diligence phase.

With all these pressure points, it’s unsurprising that so many negotiations collapse in the early stages. The M&A world is full of anecdotes of bust-ups, division and wild over-promising as emotions get the better of both sides and their advisors.

How to avoid the M&A jitters

It doesn’t have to be that way. The best M&A advisors learn how to read the room, coach their clients through flashpoints, and offer out-of-hours support and guidance throughout the sale process.

A mature unflappable advisor is adept at supporting business owners through each stage of negotiations, working behind the scenes to overcome obstacles and maintain momentum. Conversely, an indifferent or overly ruthless advisor can make things much worse – exacerbating the tension of high-stakes dealmaking.

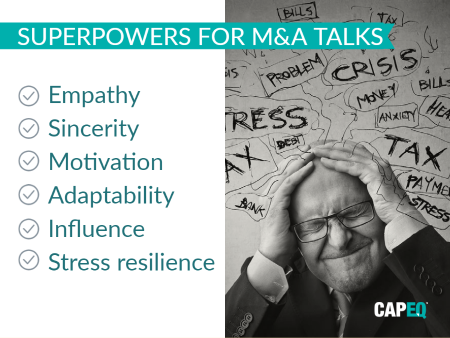

When you are building your team to take you on your exit journey, there are seven key attributes to look for in yourself and others around you to ensure M&A success.

High EQ makes things happen. Here’s how

- Relationship building – builds rapport and influence to keep all parties ‘in the room’

- Conflict management – adaptability vs over-reaction keeps doors open

- Team performance – increases potential for innovative problem solving

- Creative problem solving – open discussion avoids unwelcome surprises

- Stress management – everyone stays productive to get the job done

- Values and integrity – honest conversations with your interests at heart

- Empathetic attitude – overcome fears and frustrations to find mutual gains

This begs the question…how do you test for these attributes when hiring advisors? While there are various relevant EQ apps typically used by the recruitment industry, such a move is perhaps excessive.

The simplest method is your ‘gut feel’. When hiring a financial or legal advisor, you need to think beyond the everyday questions – sector experience, fees, confidentiality, contact network – and quietly assess their camaraderie, ethics, and language.

The same rule applies for M&A advisors as other third-party suppliers – you want to work with people you like and can trust. The rest will fall into place if you follow your instincts.

Conclusion

EQ matters more than IQ – especially in business dealings.

However, empathy, rapport and honesty are not features business owners prioritise when appointing an advisor.

At CapEQ clients often become firm friends, because we help them all the way through – from resolving shareholder conflicts long before a business comes on the market, to handling negotiations and supporting business owners through earnout and to transition into a new life post-sale.

EQ is the ‘secret sauce’ that perhaps more than anything else will help you achieve your goals.